No products in the cart.

Bookkeeping

What are non-manufacturing costs or period costs?

Once you know your total manufacturing costs, you will be able to identify where inefficiencies exist. This will help you in making changes that lead to a more efficient manufacturing process and lower costs. By understanding your total QuickBooks manufacturing costs, you will be able to identify ways to reduce your waste.

- Modern MRP systems are designed in a manner that they flexibly support and integrate into any manufacturing business process, creating a complete business management platform for your company.

- This is because while the fixed costs that are included in the production costs remain constant, variable costs do not.

- Non-manufacturing costs – not incurred in transforming materials to finished goods.

- Additionally, lower costs will also help your company to expand its operations and hire more workers – thereby ensuring that all customer demands are met, which leads to higher customer loyalty.

- Additionally, they also come with an alert feature that will notify you when you have reached the reorder point of your inventory.

- Nonmanufacturing costs consist of selling expenses, including marketing and commission expenses and sales salaries and administration expenses, such as office salaries, depreciation and supplies.

Nonmanufacturing Overhead Costs

- In addition to profitability, your pricing decisions can also impact your other strategic objectives like market share and customer satisfaction.

- Manufacturing cost is the core cost categorization for a manufacturing entity.

- While these costs are necessary for the overall functioning of the business, they do not directly contribute to the production of goods or services.

- Recall from other tutorials that variable costs change in proportion to production.

- Nonmanufacturing costs are necessary to carry on general business operations but are not part of the physical manufacturing process.

- One of the ways of doing this is to tool your manufacturing plant with more automated machines.

- However, for management objectives, managers frequently require the assignment of nonmanufacturing costs to goods.

Manufacturing overhead are costs that are not part of labor or material cost and can be either a fixed or variable cost. For instance, fixed overhead costs consist of property taxes, insurance premiums, depreciation and nonmanufacturing employee salaries, according to Accounting Tools. Whereas, variable direct manufacturing overhead costs include indirect labor, indirect material and utilities. Though most of these costs are self-evident, indirect material costs are unique because these costs are not essential to the physical production of the product. Manufacturing costs other than direct materials and direct labor are categorized as manufacturing overhead cost (also known as factory overhead costs). They usually include indirect materials, indirect labor, salary of supervisor, lighting, heat and insurance cost of factory etc.

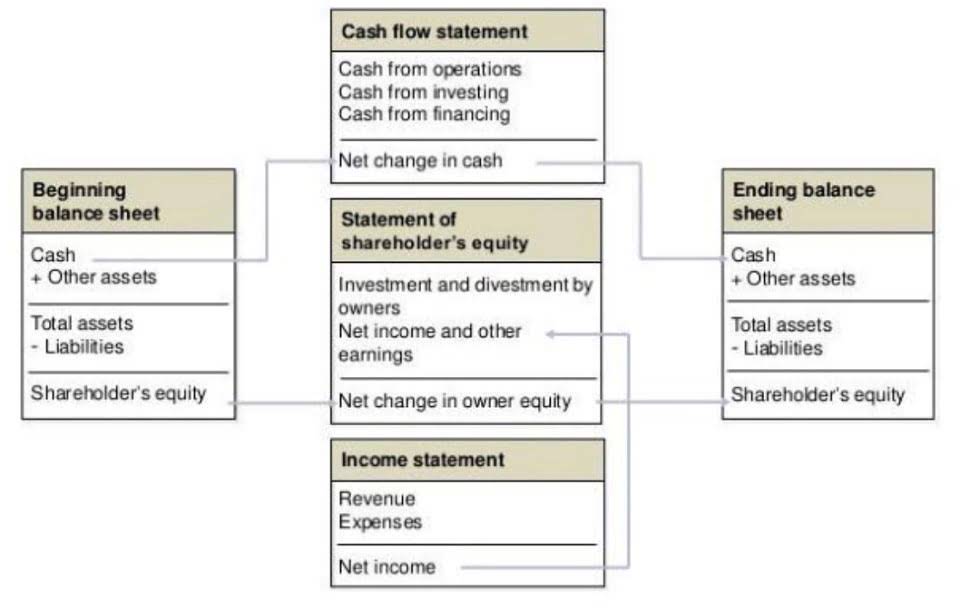

Make Use of Waste and Leftover Material

Nonmanufacturing costs are necessary to carry on general business operations but are not part of the physical manufacturing process. These costs are represented during a period of time and are not calculated into the cost of good sold. Nonmanufacturing costs consist of selling expenses, including marketing and commission expenses and sales salaries and administration expenses, such as office salaries, depreciation and supplies. The purpose of addressing these costs differently as https://www.bookstime.com/ part of a total manufacturing cost formula is based on the fact that they are accounted for differently when structuring the income statement and balance sheet. Even though nonmanufacturing overhead costs are not product costs according to GAAP, these expenses (along with product costs and profit) must be covered by the selling prices of a company’s products. In other words, selling prices must be large enough to cover SG&A expenses, interest expense, manufacturing overhead, direct labor, direct materials, and profit.

Strategic Cost Management

Direct materials – cost of items that form an integral part of the finished product. Examples include wood in furniture, steel in automobile, water in bottled drink, fabric in shirt, etc. These insights will thus help you in saving materials, labor, and other resources. In fact, sometimes, just by making a few small changes to your routing manufacturing, you will be able to have significant savings. Thus, with an increase in production, the per-unit production cost decreases, making your business more profitable. This motivates many businesses to continue expanding their production up to its total capacity, thereby maximizing their profits.

In fact, by using the insights provided by the manufacturing costs, you will be able to find out whether you are meeting your goals and whether your production process is conducive to your desired level of productivity. Thus, manufacturing costs are constantly under change, getting impacted by its various determining factors. But considering that the success of the business depends on its productivity as well as profitability, having an accurate prediction of its manufacturing costs will help it in reaching its targets. The finished product of a company may become raw material of another company. For example, cement is a finished product for manufacturers of cement and raw non-manufacturing costs include materials for companies involved in construction business. Manufacturing and non-manufacturing costs together form total costs for a manufacturing entity.